New Card Management Features and Updated Mobile and Online Banking Design Now Available

“At Wright-Patt Credit Union® (WPCU®), we believe being a caring financial partner means listening, learning and making intentional updates to better serve our members. We’re excited to be making updates related to our card programs based on feedback we heard from you. This is the first step of several to enhance your experience and serve your needs.”

“At Wright-Patt Credit Union® (WPCU®), we believe being a caring financial partner means listening, learning and making intentional updates to better serve our members. We’re excited to be making updates related to our card programs based on feedback we heard from you. This is the first step of several to enhance your experience and serve your needs.”

– Tim Mislansky, WPCU President & CEO

We are excited to share that the improvements that will make accessing your WPCU credit, debit and/or HSA cards easier and more convenient in consumer Mobile and Online Banking, as well as a refreshed look and member experience throughout all of consumer Mobile and Online Banking, are now available. We appreciate your patience and understanding as we postponed the release of these new features.

PLEASE NOTE: Wright-Patt Credit Union® (WPCU®) has updated our Electronic Services Agreement and Disclosure Statement (the “Agreement”) to include the use of biometrics (such as facial or fingerprint recognition) for unlocking devices or logging into applications and to reflect the improvements being made to our Card Management Services within Mobile and Online Banking. As a result, you will be required to review and accept the new Agreement the next time you log into Mobile and/or Online Banking, beginning November 5, 2025, in order to continue using WPCU’s Mobile and Online Banking. View the full Electronic Services Agreement and Disclosure Statement.

You can find a list of all the updates, including a preview of the new features below. Use this page as a resource for step-by-step instructions on how to take advantage of these new features.

Here's What's Coming Soon

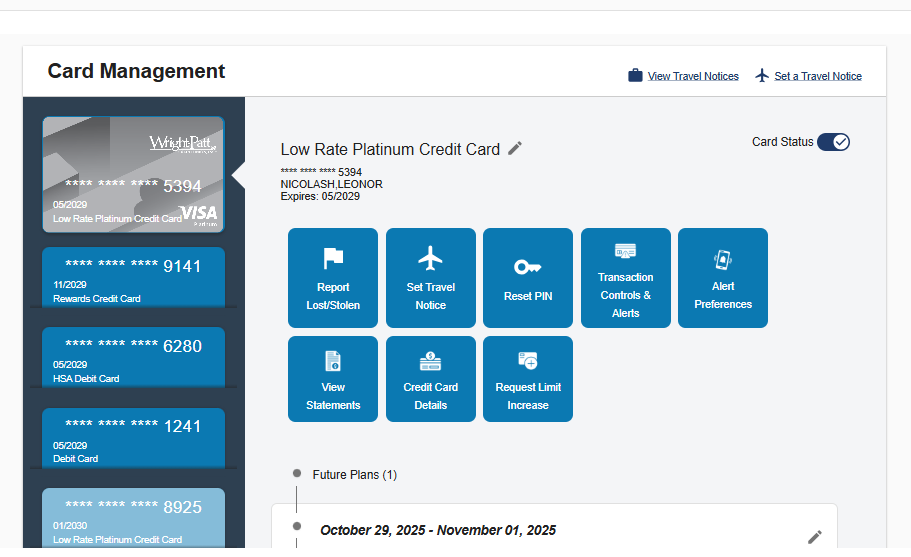

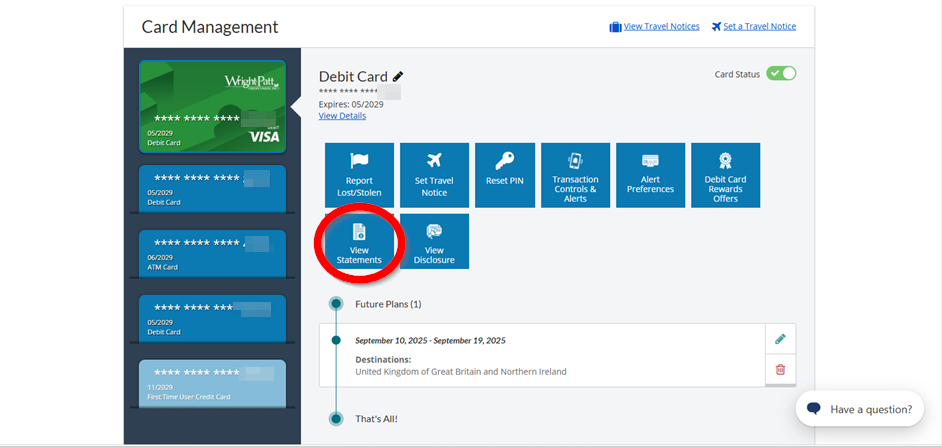

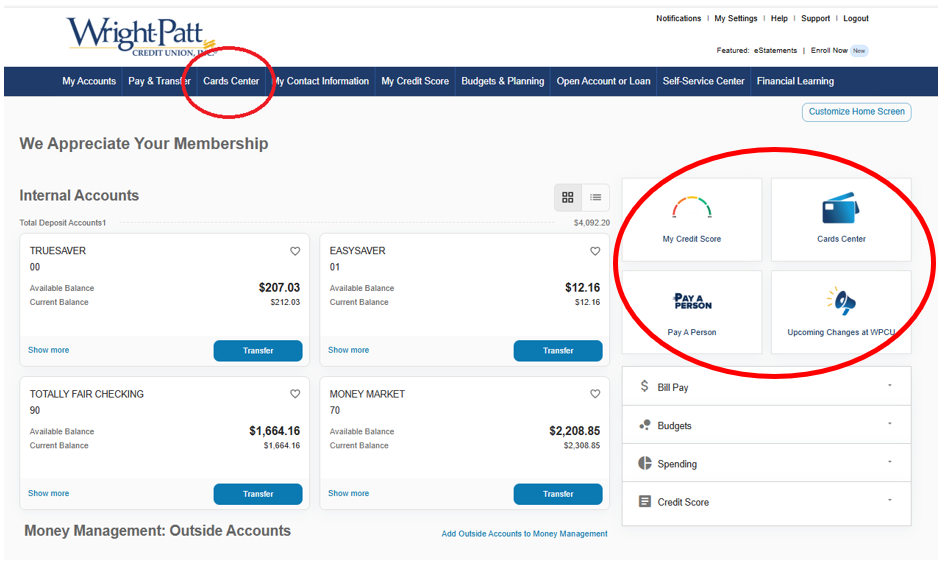

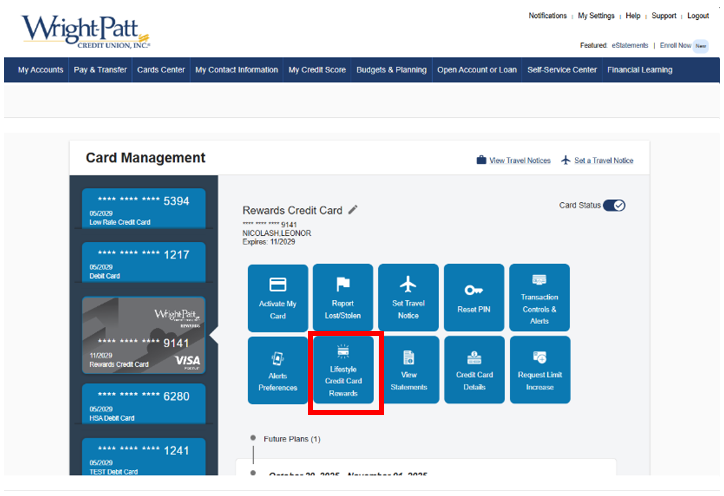

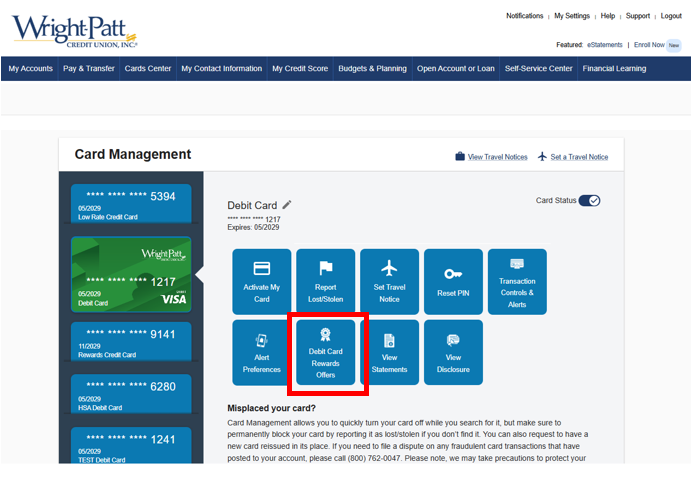

You can access and manage your WPCU credit, debit and HSA cards in one central location within the Cards Center in Mobile and Online Banking.

Here, you can access quick options for each of your cards, such as Debit Card Rewards Offers or Lifestyle Credit Card Rewards.

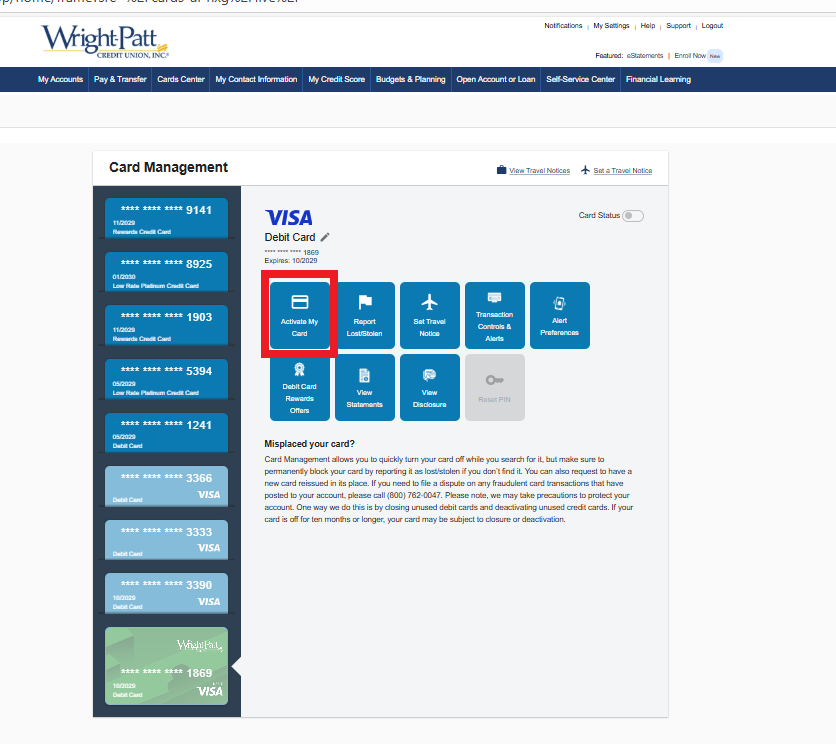

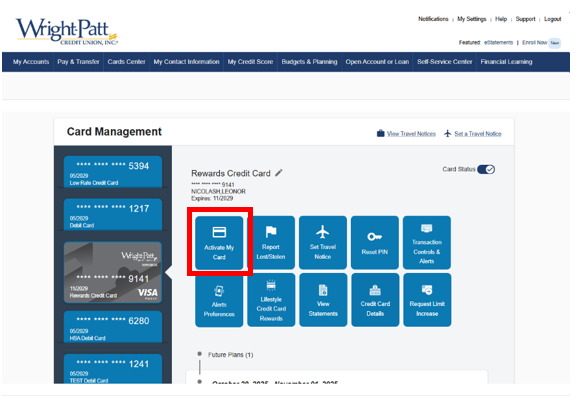

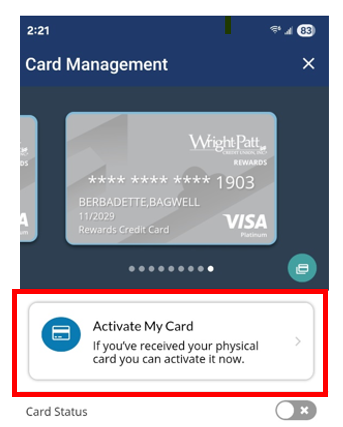

You are able to quickly activate a new credit, debit or HSA card directly in your Cards Center.

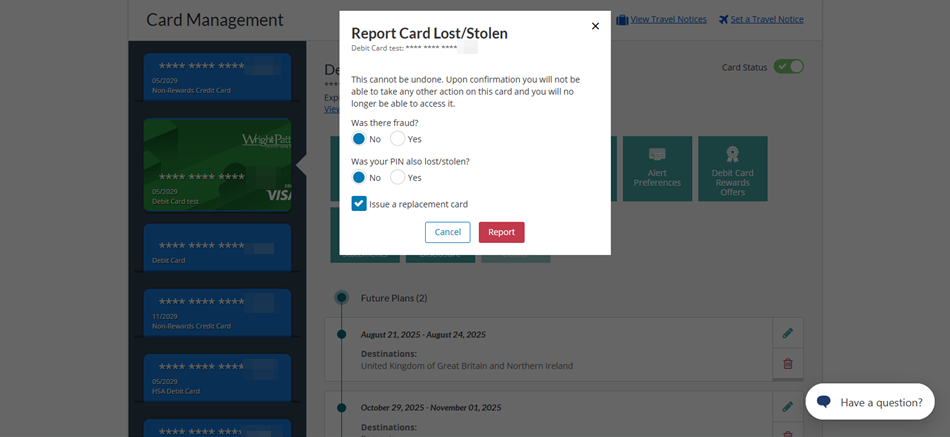

If your card has been lost or stolen and needs access permanently turned off, you are able to easily report your card as lost or stolen in Card Management, and order a replacement card.

Please Note:

- For ATM or Debit Cards that are reported as lost or stolen, you will need to check the "Issue a replacement card" box if you would like a replacement card. Credit Cards reported as lost or stolen will automatically order a replacement card.

- For Business Debit or Credit Cards that are reported as lost or stolen, there is a 2-3 day processing window. You should receive your replacement card(s) within 10-12 days of being reported lost or stolen.

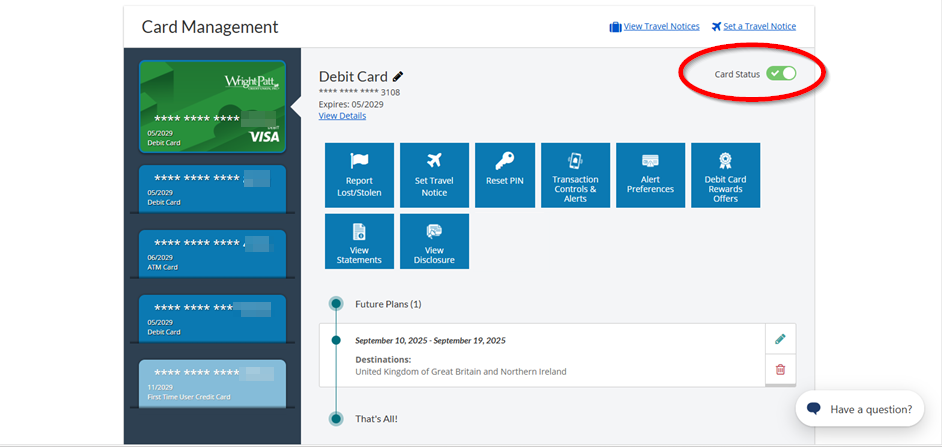

To temporarily turn off access to your card, you are able to adjust your Card Status to off, then easily turn it back on when you're ready.

You are able to let WPCU know when you’ll be traveling so we don’t decline debit or credit card purchases made in areas outside your usual spending patterns as part of our fraud prevention efforts. You can add any of your active, eligible cards to each notice.

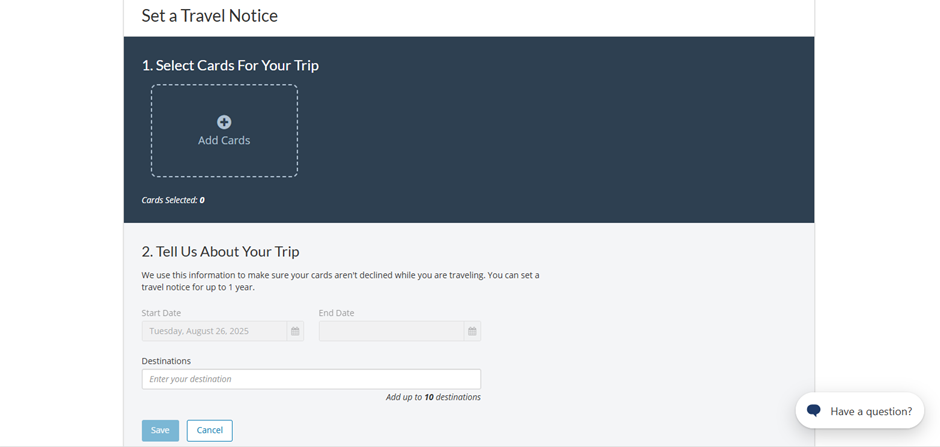

Follow these steps to set up travel notices:

- Select "Set a Travel Notice":

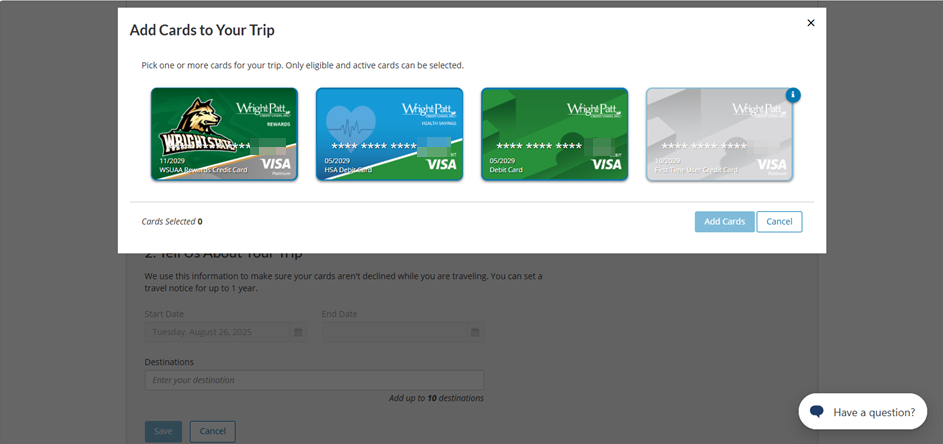

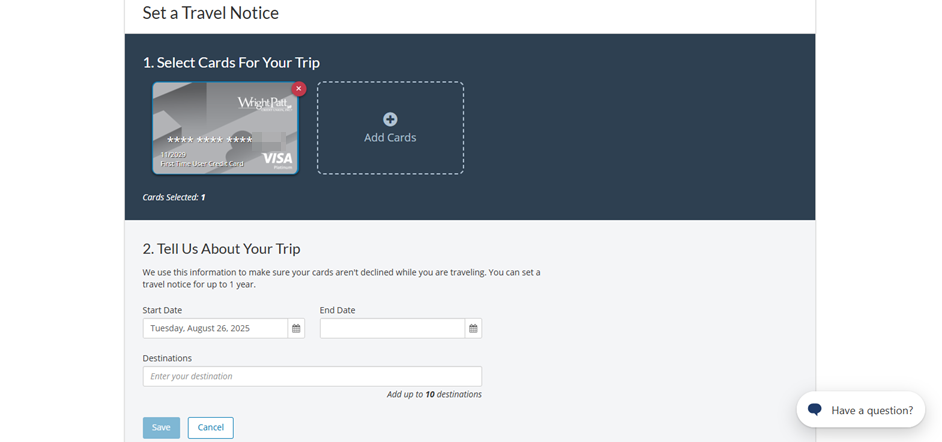

- Select from your eligible, active cards:

- Enter your dates and destination(s), then click Save:

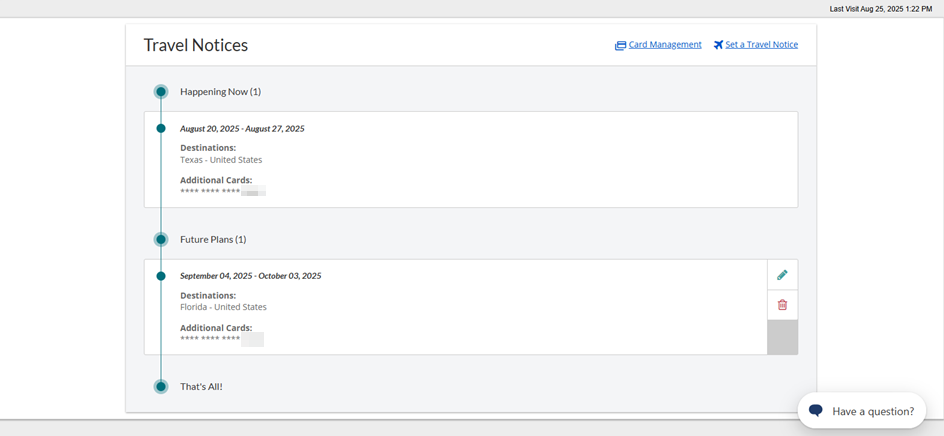

- View all your Travel Notices in one place:

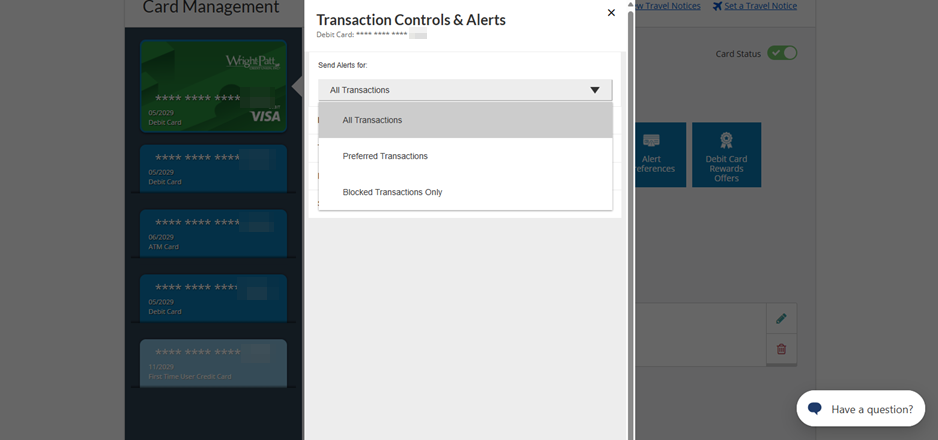

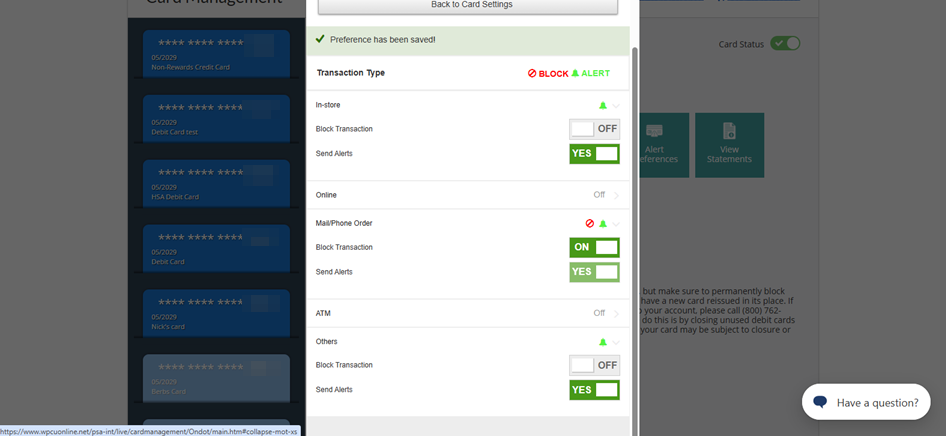

You are able to get near real-time transaction alerts for transactions made with your card. You can opt to receive notifications for all transactions (default option), preferred transactions or blocked transactions.

Follow these steps to set your transaction alerts:

- To set your Transaction Alerts, navigate to the Transaction Controls & Alerts button in Card Management and select from the drop down menu. If you select All Transactions or Blocked Transactions Only, your preference will be saved. If you select Preferred Transactions, please follow the next steps.

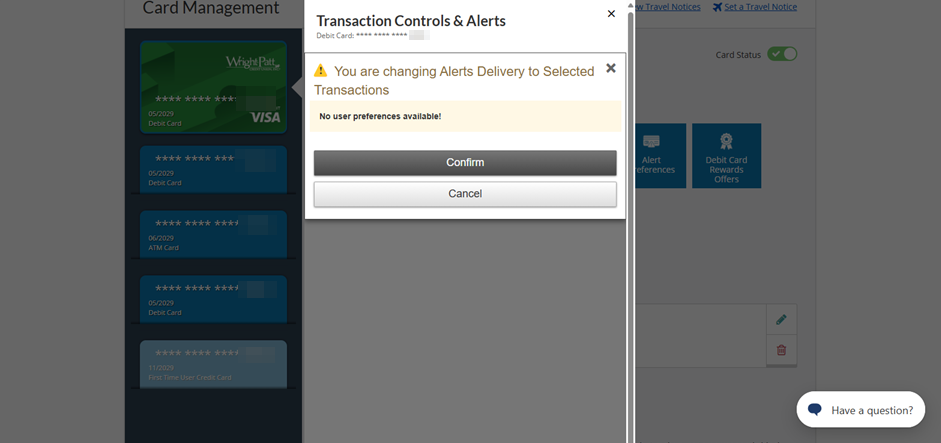

- You will be asked to confirm that you are changing Alerts Delivery to Selected Transactions, select Confirm.

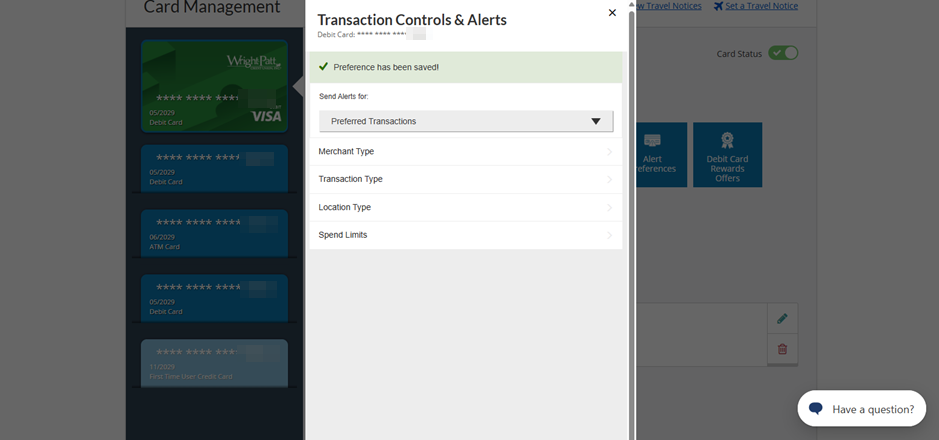

- Your preference will be saved, now you can modify the details for the transactions you would like alerts for, based on Merchant, Transaction, Location or Spend Limit.?

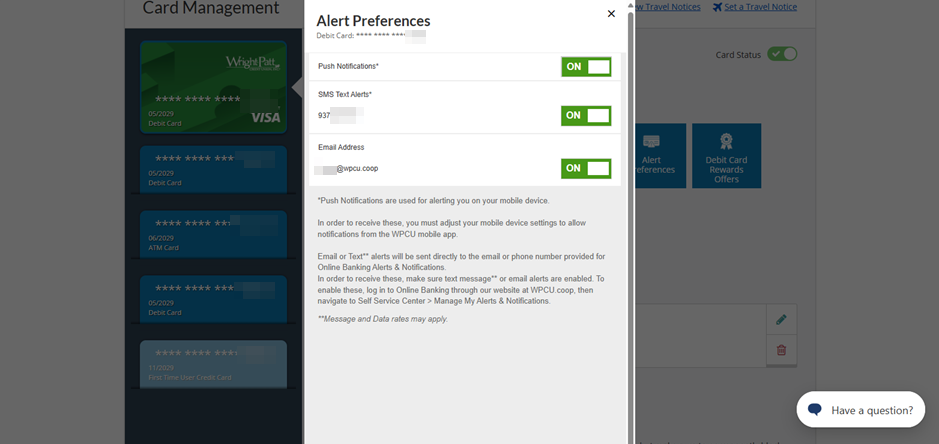

You can also manage your Alert Preferences by navigating to the Alert Preferences button in Card Management and select how you'd like to receive alerts. Your options include Push Notifications, SMS Text Message and/or Email Address.

- Push Notifications are used for alerting you on your mobile device. In order to receive these, you must adjust your mobile device settings to allow notifications from the WPCU mobile app.

- Email or Text alerts will be sent directly to the email or phone number provided for Online Banking Alerts & Notifications. Message and Data rates may apply.

You are able to set transaction controls, including limits and restrictions on the use of your card. These can be based on transaction amounts, locations, merchant or transaction type. These controls will deny any transactions that meet the criteria specified, and you will be notified that the transaction was stopped due to the control limits.

You are able to view your credit card statements in the same place as your other WPCU account statements, with quick access to your eStatements via the new Cards Center.

Plus a New Mobile and Online Banking Experience

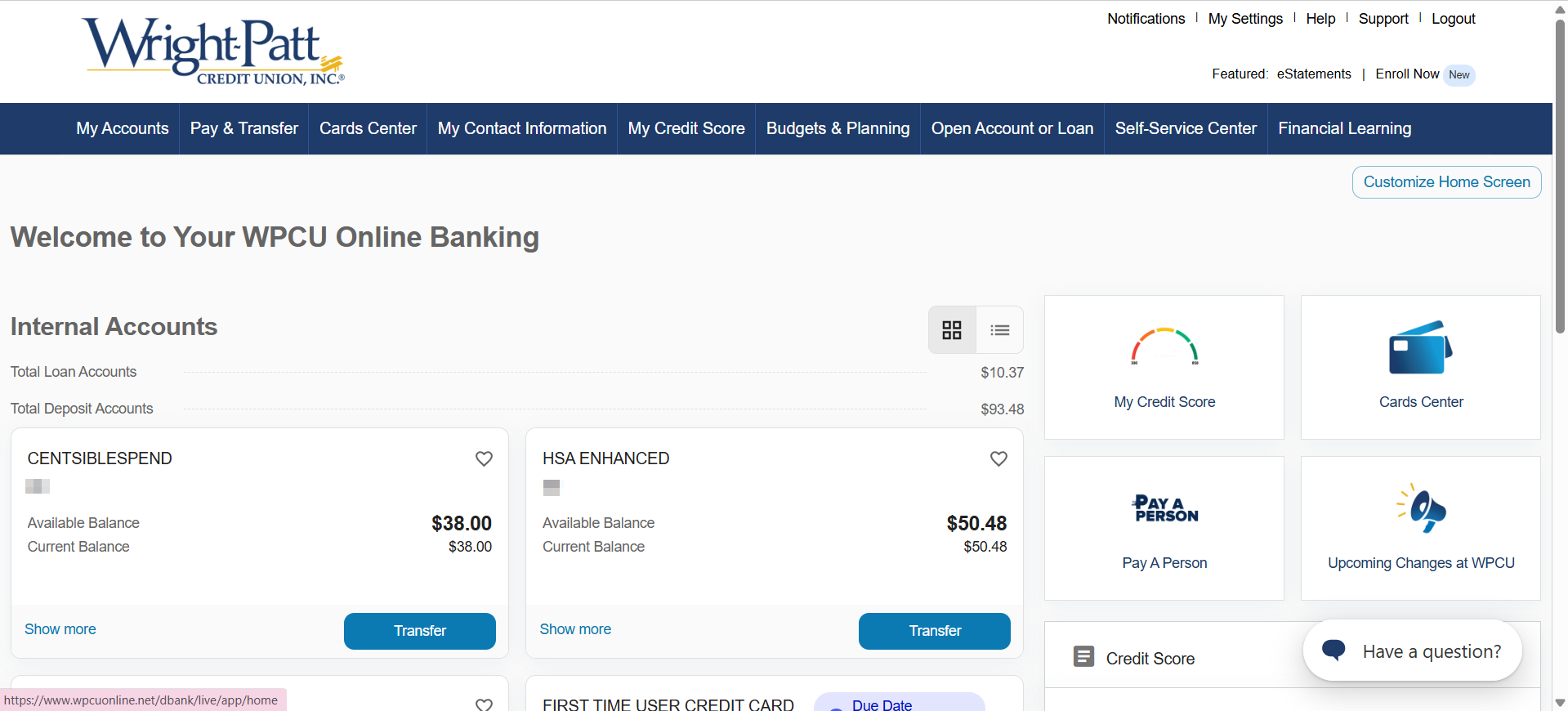

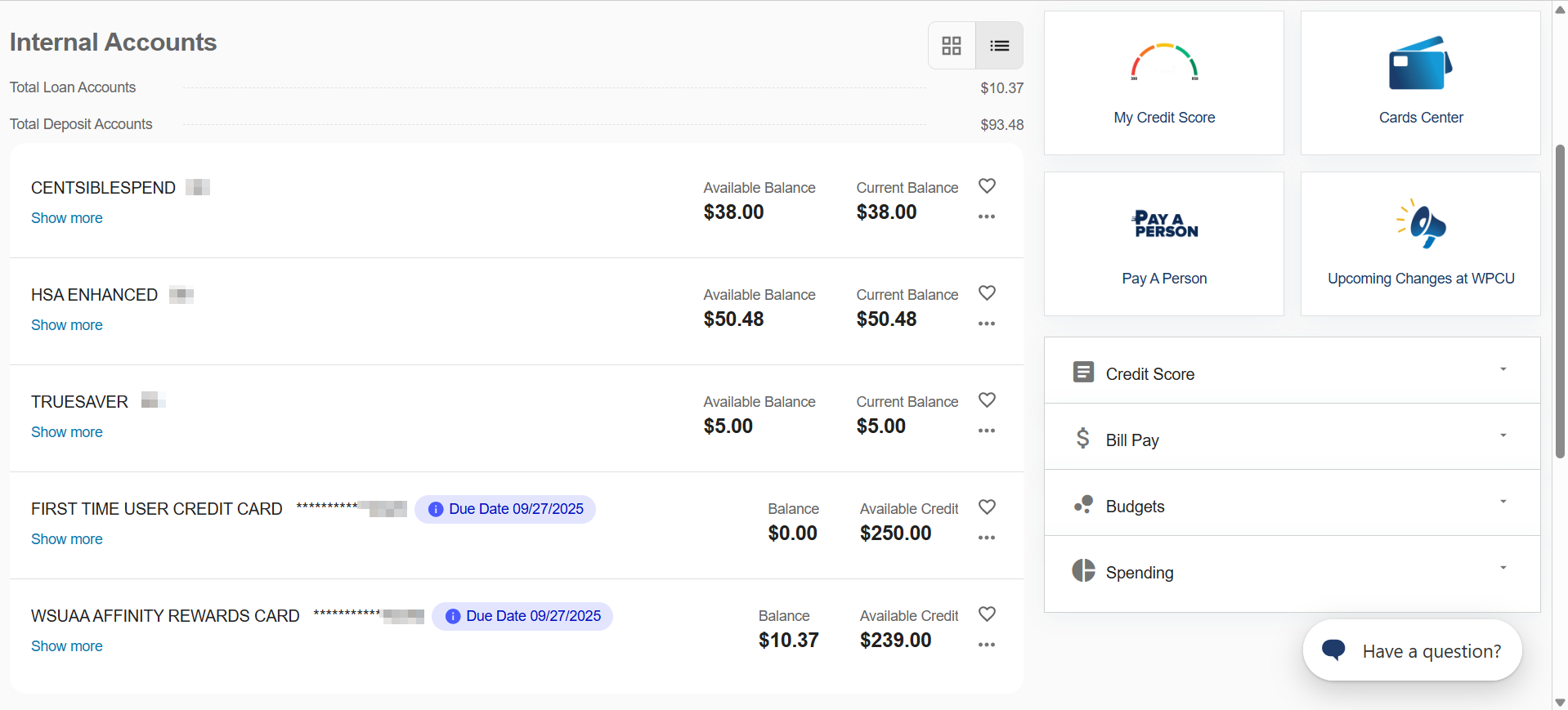

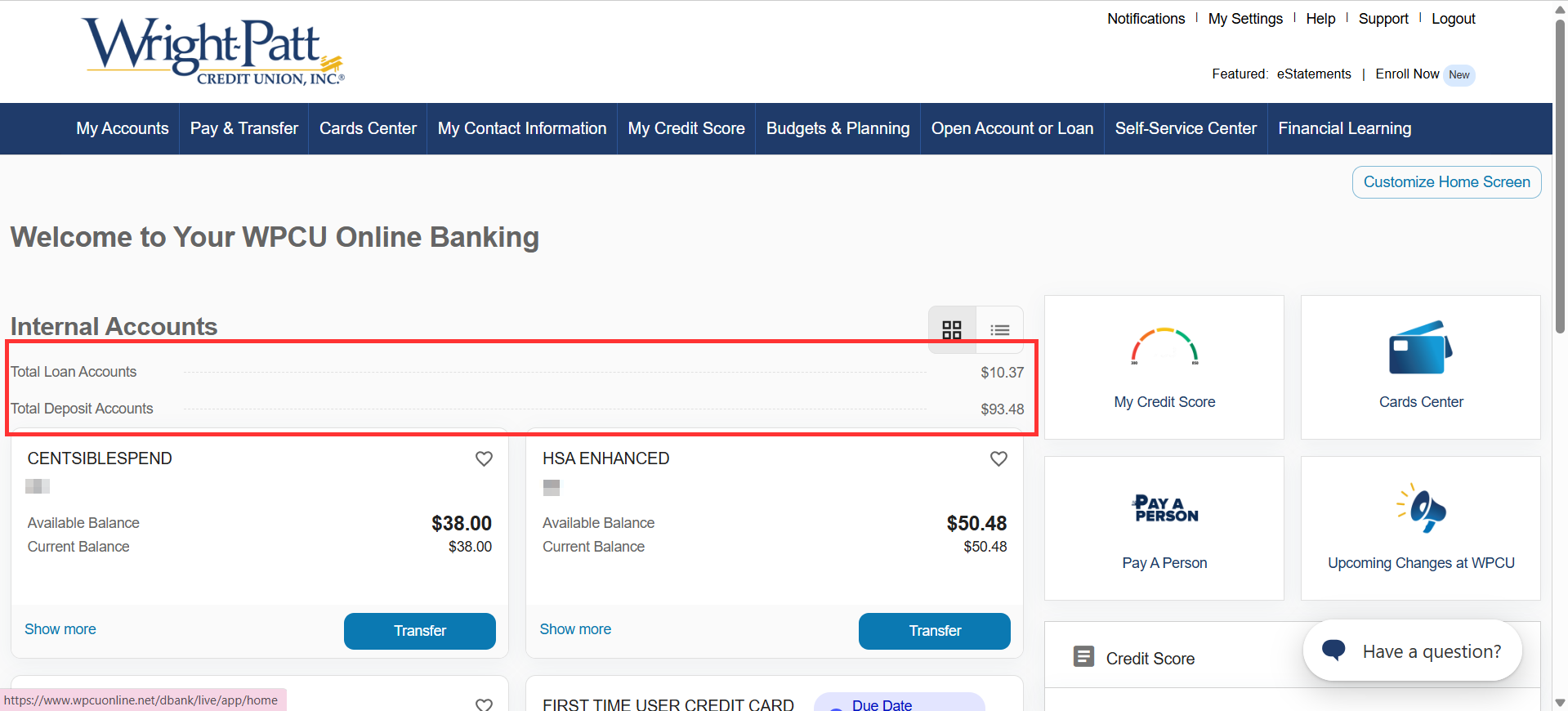

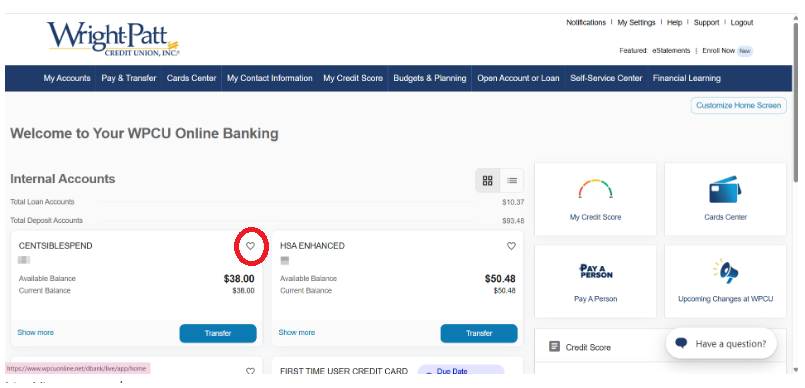

Your "My Accounts" page has multiple customizable options, including:

- Choose "Tile View" or "List View" to view your account info

- Tile View example:

- List View example:

- Tile View example:

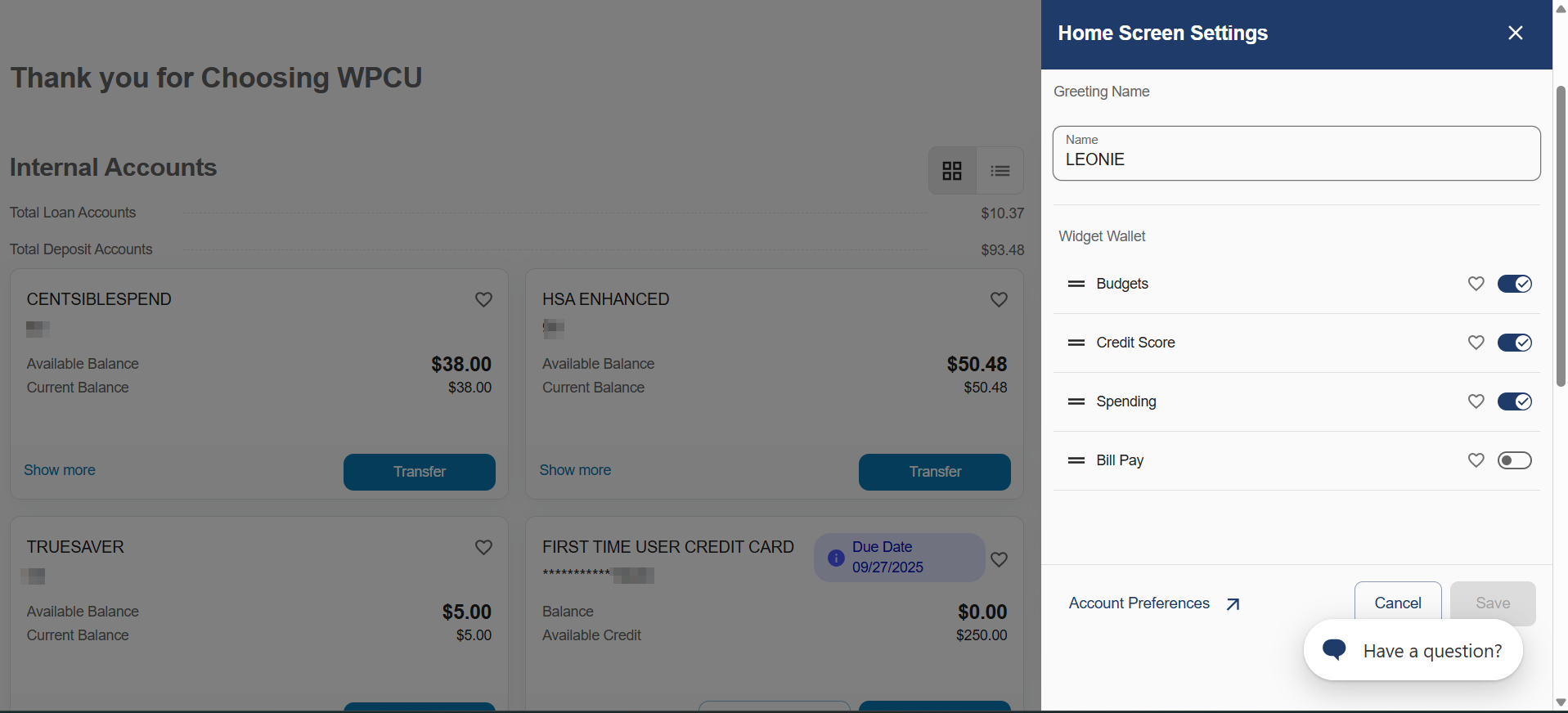

- Widgets are in one central location, including: Credit Score, Bill Pay, Budgets, and Spending. You are able to pick which widgets you want to show, and arrange them in your preferred order.

You have a quick look at your total loan accounts and deposit accounts right at the top of your screen.

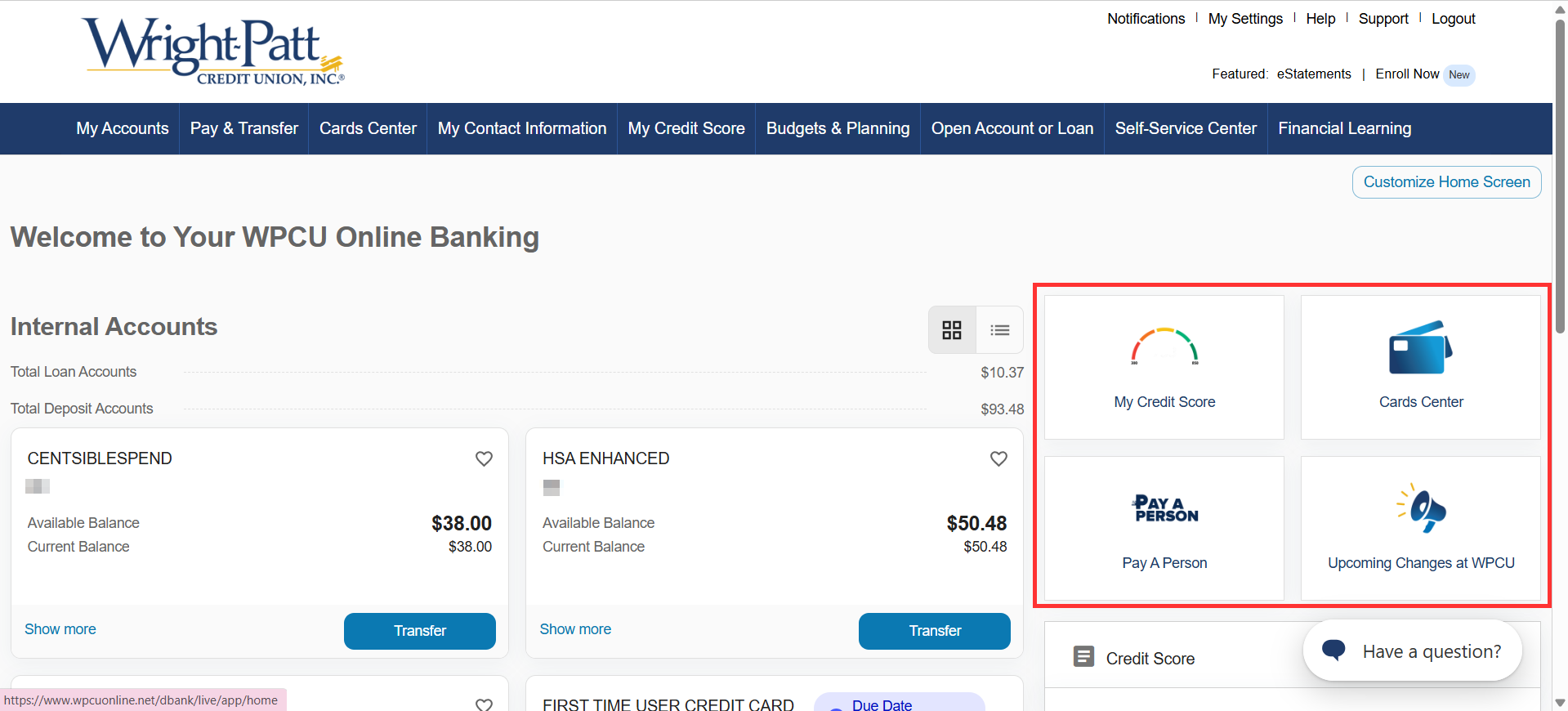

You have quick access to our most popular Digital Services, plus with our new "Upcoming Changes at WPCU" page, you can stay in-the-know on credit union changes.

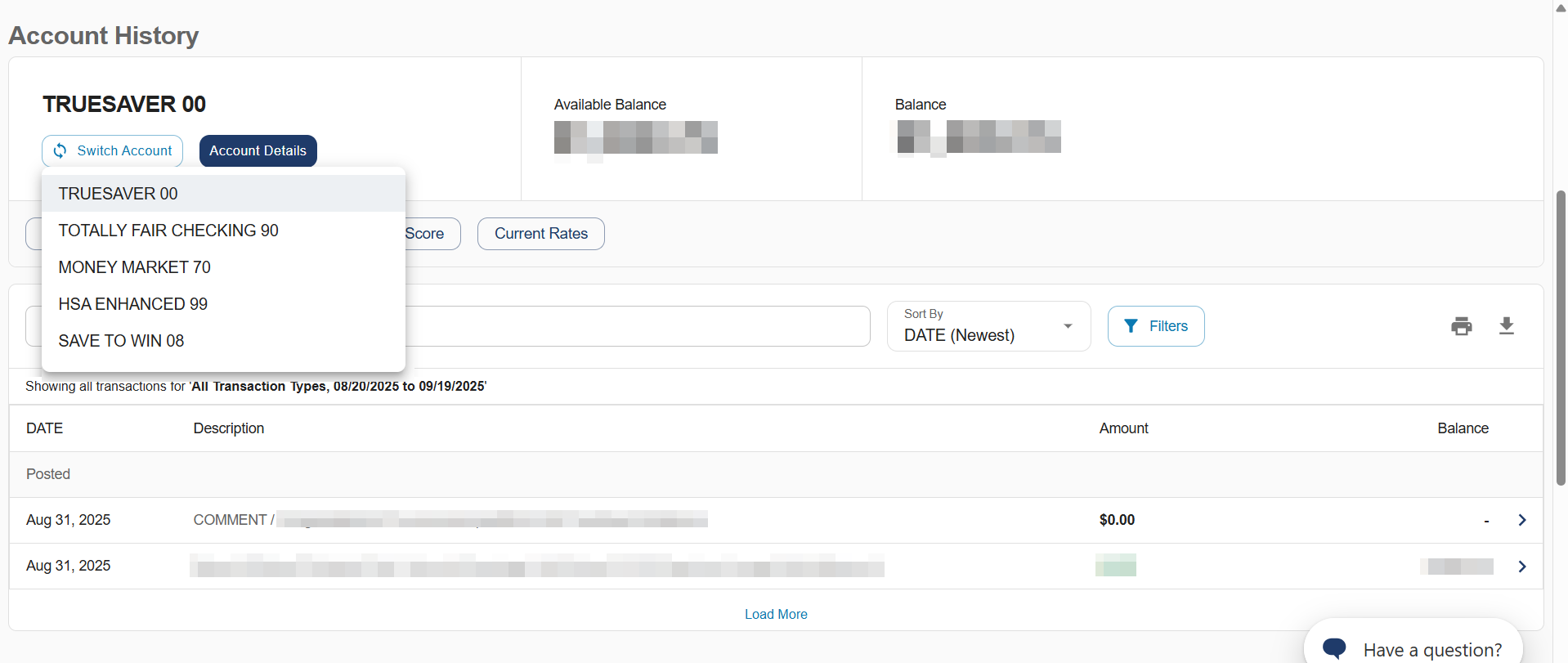

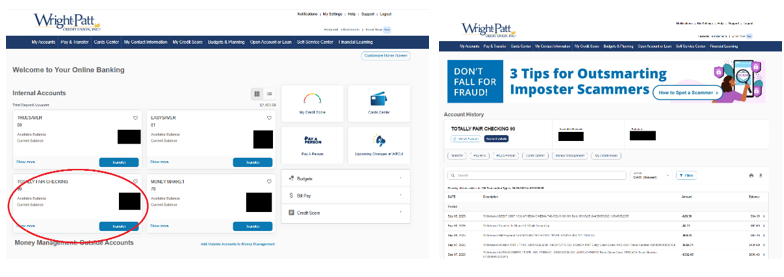

The "Account History" page has a refreshed look and feel, including the option to quickly "Switch Accounts" and view Account History for your other WPCU shares or loans.

If you haven’t already, now’s a great time to enroll in Mobile and Online Banking to access tools and services that make managing your money easier and more convenient.

Frequently Asked Questions

-

No, this change will not affect how your log-in to your accounts.

-

Yes – this update still shows all your accounts on the “My Accounts” page. Plus, easy access for popular banking features like My Credit Score, Cards Center, Pay a Person, Bill Pay and more.

-

You can customize your “My Accounts” page by:

-Selecting your Favorite Accounts so that they always show at the top (select the heart next to the account).

-

Click on “Customize” at the bottom of your home screen to:

Set Your Account Preferences

Show/Hide Accounts

Account Nicknames

-

Select the account you want to view, this will take you to the Account History.

-

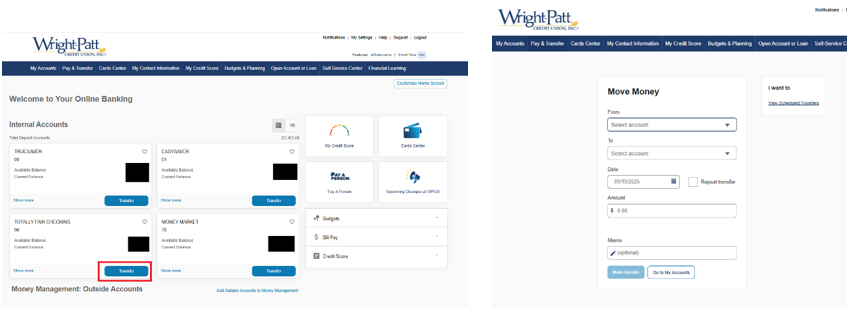

Select “Transfer” on the “My Accounts” page and then complete the transfer on the next screen:

-

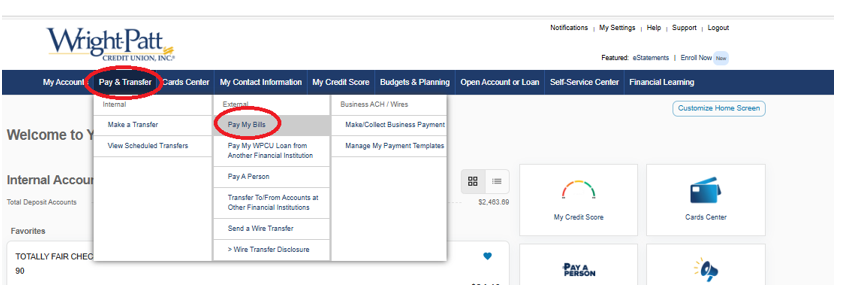

Select “Pay & Transfer” from the top menu then “Pay My Bills"

-

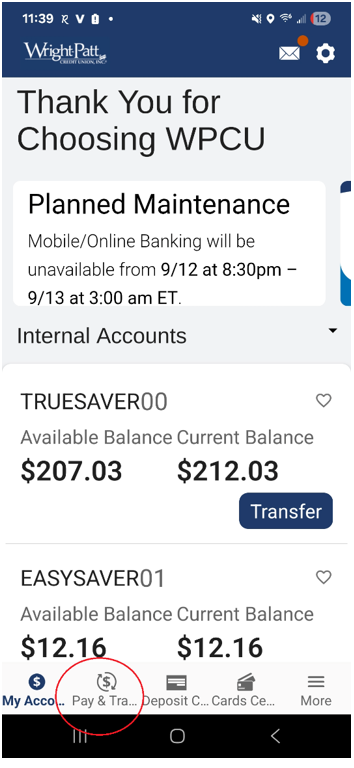

Select “Pay & Transfer” at the bottom of your screen.

-

Choose the “Activate My Card” tile (highlighted below) in Card Management and follow the prompts to easily activate your card from your mobile device or online.

Online:

Mobile:

-

Choose the “Lifestyle Credit Card Rewards” from the Card Management Screen and this will take you to your Rewards account to view your balance, point history and redemption.

-

Choose the “Debit Card Reward Offers” from the Debit Card, Card Management Screen and this will take you to your Debit Card Rewards account.

-

There may be a 1-2 day delay in updating the image of the card shown in Mobile and Online Banking. During that time, you may see an image of the standard version of the Debit/HSA/Credit Card which will update to the one you have chosen.