Updated and Improved Access to Your WPCU® Credit Card Account in Mobile and Online Banking

Credit Card Account Information is Now Available in Business Mobile and Online Banking

Thank you for your continued patience and understanding as we’ve worked through challenges our members have experienced over the past six months following our credit card conversion. We heard the frustration from our business members regarding the inability to easily access your credit card account in Business Mobile and Online Banking.

We’ve been working to address this issue and we’re happy to share that you are now able to access your credit card account in Business Mobile and Online Banking without having to log in with a separate set of credentials. Additionally, in Business Online Banking you will be able to access your credit card account directly from your “My Accounts” page.

How to Access Your Credit Card Information

Access your credit card account from the Business Mobile and Online Banking page by following the steps below.

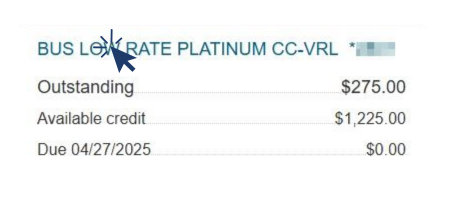

Access your credit card account from the main Online Banking page by selecting your credit card account. This will take you directly to your account to view transactions, manage your credit card and more.

- Log into Business Online Banking.

- Select the credit card account from the "My Accounts" page:

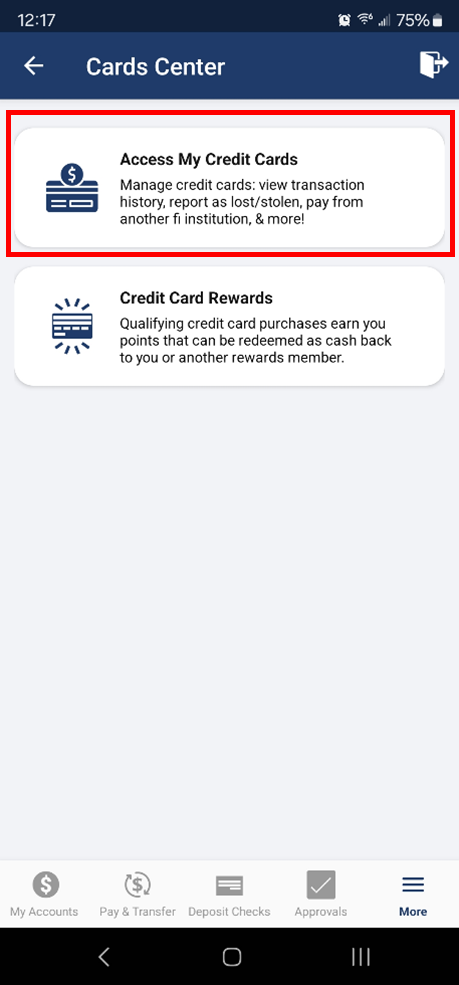

After you have logged in to Business Mobile Banking, navigate to the Cards Center from the More menu and select Access My Credit Cards. From here, simply select the credit card account you wish to view to see your account balance, schedule payments, manage your account and more.

- Log into Business Mobile Banking.

- Select "More" and then "Cards Center".

- Select "Access My Credit Cards".

Frequently Asked Questions and Answers

We would also like to provide you answers to Frequently Asked Questions to help you navigate through changes to your credit card account. Please review the questions and answers below. We will continue to update this page with additional questions and answers, so please be sure to check back frequently.

-

Yes, credit card statements will now be sent separately from your WPCU account statement beginning with your October 2024 credit card statement.

-

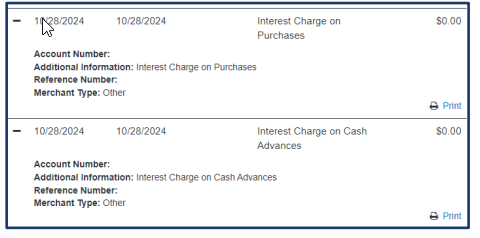

You will see these two items separated out on your credit card account statement and in Mobile and Online Banking. The reason “Interest Charge on Purchases” and “Interest Charge on Cash Advances” are separated is that interest accrues differently for these two types of transactions. For Cash Advances and Balance Transfers, interest begins to accrue immediately, whereas for Purchases, interest begins accruing after your statement is issued if you do not pay the balance in full each month.

You will see these two items separated out on your credit card account statement and in Mobile and Online Banking. The reason “Interest Charge on Purchases” and “Interest Charge on Cash Advances” are separated is that interest accrues differently for these two types of transactions. For Cash Advances and Balance Transfers, interest begins to accrue immediately, whereas for Purchases, interest begins accruing after your statement is issued if you do not pay the balance in full each month. -

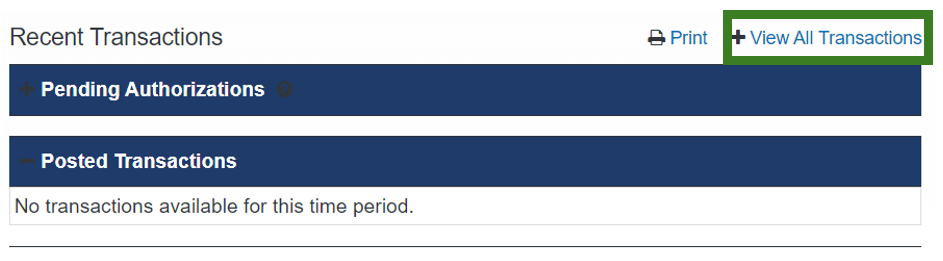

“No transactions available for this time period” will show if there have been no transactions since the most recent statement. You can select “View All Transactions” to see your previous transactions.

-

Cash advances can be completed by bringing your physical credit card to your nearest WPCU Member Center or any financial institution that offers cash advances. Cash advances can also be completed at an ATM; however, you will have to reset your PIN after October 13, 2024.

Please note: Wright-Patt Credit Union does not charge any fees for members to complete a cash advance using their Wright-Patt Credit Union card; however, other financial institutions may.

-

Your credit card interest rate is not visible in “Access My Credit Cards.” To see your interest rate, please refer to your credit card statement.

-

You can schedule an internal transfer payment from your WPCU savings or checking account for a specific date by selecting “Schedule a Payment” in Mobile or Online Banking.

Please note: Any recurring payments set up in “Access My Credit Cards” will be scheduled for the your payment due date. This date cannot be changed.

You can also make a payment by visiting your nearest Member Center or contacting our Member Help Center at (800) 762-0047 during regular business hours.

-

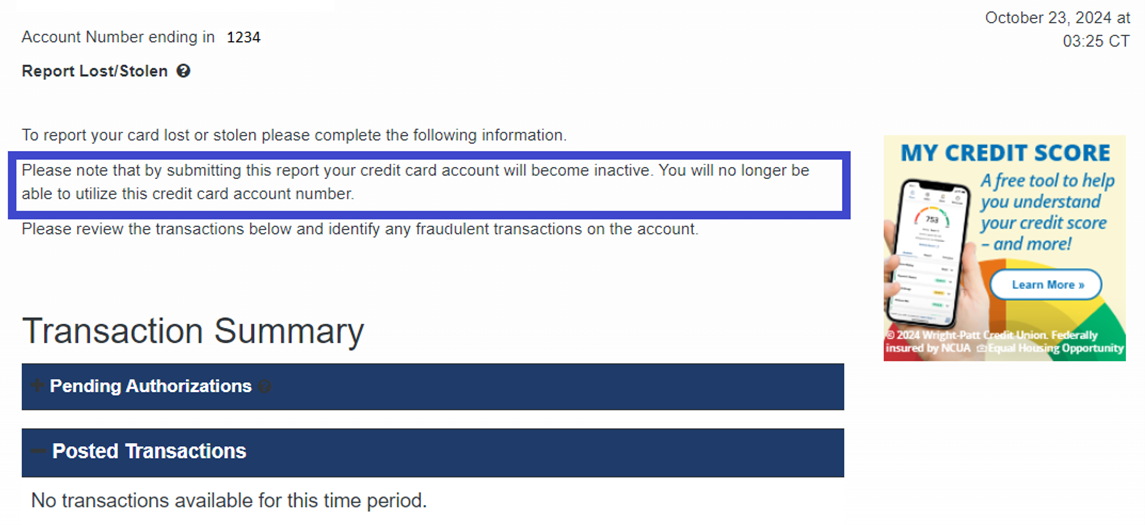

If your card is lost or stolen, you can block your card in “Access My Credit Cards”. Please note, this will permanently block your card and it cannot be unblocked.

If you believe your card is simply misplaced – and not actually lost or stolen – you can contact our Member Help Center at (800) 762-0047 to have a temporary block placed on your card. Once you locate your card, you can contact the Member Help Center to remove the temporary block.

-

This depends on how you are accessing your credit card information. Please see the information below for an example of each.

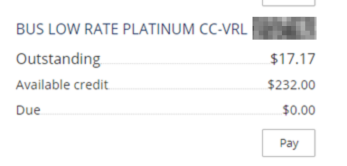

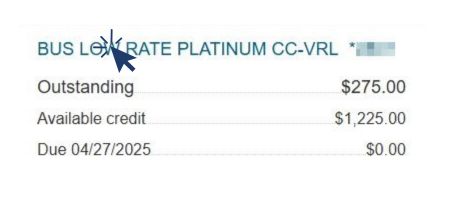

Online Banking – My Accounts Page

When viewing your account in Online Banking, the last 4-digits that appear next to the loan name references a number used by WPCU to identify your account and is not intended to match your credit card number.

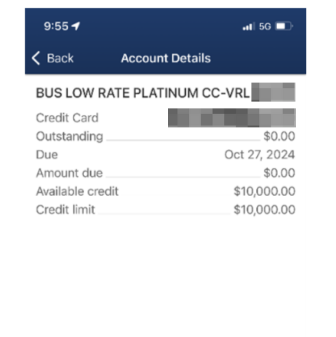

Mobile Banking – My Accounts Page

If you select “Show Details” or “Details” when viewing your credit card account in Mobile Banking, a 16-digit number will appear in the credit card field. This number is simply a reference number used by WPCU to identify your account and is not intended to match your credit card number.

.png)

-

The timing of when your payment is withdrawn from your account is dependent on how your payment was made:

- Member, self-serve transfer payments made in Mobile or Online Banking are withdrawn immediately.

- Teller-assisted check or internal transfer payments are withdrawn immediately.

- Teller-assisted payments from an external account or financial institution (ACH) are withdrawn within 2-3 business days.

- Payments made by members through Access My Credit Cards in Mobile or Online Banking from an external account or financial institution (ACH) are withdrawn within 2-3 business days.

-

The timing of when your payment will be posted and reflected in your balance and available balance is dependent on how your payment was made:

- Internal transfers from your WPCU share/checking account in Mobile or Online Banking:

- Member self-serve transfer payments submitted before 4:30PM in Mobile or Online Banking will post the next business day, with an effective date of the date the payment was submitted/scheduled.

- Member self-serve payments submitted after 4:30PM in Mobile or Online Banking will post in 2 business days, with an effective date of the date the payment was submitted/scheduled.

- Teller-assisted cash, check, and internal transfer payments:

- Teller-assisted payments submitted before 4:30PM will post the next business day, with an effective date of the date the payment was submitted.

- Teller-assisted payments submitted after 4:30PM will post in 2 business days, with an effective date of the date the payment was submitted.

- Teller-assisted payments made from an external account or financial institution (ACH) can take 2-3 business days to post.

- Internal transfers from your WPCU share/checking account in Mobile or Online Banking:

-

Please visit any Member Center or call our Member Help Center at (800) 762-0047.

Additional Information Regarding Your Credit Card Information and Account History

- You can continue to make payments to your credit card via internal transfer from a WPCU share account (savings/checking) or by setting up a payment account within "Access My Credit Cards" in Business Mobile and Online Banking.

- NOTE: Credit card payments made in Business Mobile and Online Banking or via internal transfer from a WPCU share may not be reflected in your credit card balance or transaction history for up to 2 business days.

Again, we sincerely apologize for any inconvenience and appreciate your understanding.

For questions or help with WPCU's Digital Services, visit your nearest Member Center or call the Member Help Center at (800) 762-0047.