Fraud Alert: Spoofing Scams Are on the Rise — Stay Alert and Protect Your Accounts!

Wright-Patt Credit Union® (WPCU®), like many financial institutions, is seeing an increase in spoofing scams - fraudulent attempts aimed at gaining unauthorized access to member accounts and member business accounts.

Scammers are using fake phone calls, text messages, and emails that appear to come from Wright-Patt Credit Union. These spoofed communications may look and sound convincing — but they’re designed to trick you into sharing sensitive information.

What Is Spoofing?

Spoofing is when scammers disguise their communication to look like it’s coming from a trusted source — in this case, Wright-Patt Credit Union. These messages may seem urgent, credible, and convincing, but they are designed to steal your personal and financial information.

Red Flags to Watch For

If you receive a suspicious message or call claiming to be from WPCU, remember:

- Do NOT click on any links.

- Do NOT call any phone numbers provided in the message.

- Do NOT enter your username, password, or security codes into any website linked in the message.

- Do NOT provide information over the phone like,

- Passwords

- PIN codes

- CVC codes

- Full or partial account numbers

- Social security number or other personal information

No matter how urgent, credible or convincing they sound, do NOT give out this information.

What to Do If You’re Contacted

If you receive a suspicious call, text, or email:

- Stop.

- Hang up or delete the message.

- Call WPCU directly to validate the communication.

You can reach us at:

- (937) 912-7000

- (800) 762-0047

- Visit WPCU.coop and log into Online Banking securely

Stay Safe and Informed

Your security is our top priority. WPCU actively monitors accounts for fraudulent activity, but staying alert and informed is your best defense. If you ever have questions or concerns, don’t hesitate to contact us directly.

Don’t fall for fraud — stay vigilant and protect your accounts!

9/25/2025

Fraud Alert: Don’t Fall for Fake WPCU® Texts

Wright-Patt Credit Union® (WPCU®) is seeing a rise in fraudulent text messages falsely claiming to be from WPCU. These messages often warn of a pending or suspicious transaction and prompt you to click a link to verify your account.

Do not click on any links in these messages.

These are scams designed to steal your personal and account information.

Important Reminder:

WPCU will NEVER text, call, or email you unexpectedly to ask for:

- Your password

- PIN codes

- Personal or account information

If You Receive a Suspicious Message:

No matter how legitimate or urgent it may seem, do not:

- Share any personal information

- Click on any links

- Call any phone numbers provided in the message

- Enter information on any linked websites

What You Should Do Instead:

- Delete the message immediately

- Hang up if you receive a suspicious call

- Contact Wright-Patt Credit Union directly at:

- (937) 912-7000

- (800) 762-0047

- Visit WPCU.coop and log into Online Banking securely

Spot the Signs: Protect Yourself from Scams

Staying alert is your best defense. Watch for these red flags:

- Unfamiliar Sender: Is the message from a number you don’t recognize?

- Urgency or Threats: Does it pressure you to act immediately or use scare tactics?

- Suspicious Links: On a computer, hover over links to see their true destination. On mobile, avoid clicking altogether.

- Poor Grammar or Spelling: Many scam messages contain errors.

For more tips on fraud prevention and cybersecurity best practices, visit:

WPCU.coop/StopFraud

9/2/2025

Fraud Alert: Don’t Fall for AI-Fueled "Phantom Hacker" Scam

An alarming and sophisticated new scam is actively targeting and emptying the savings accounts of seniors (and others) across America. It's called the "Phantom Hacker" scheme, and it's particularly deceptive because it uses artificial intelligence to make it even more convincing.

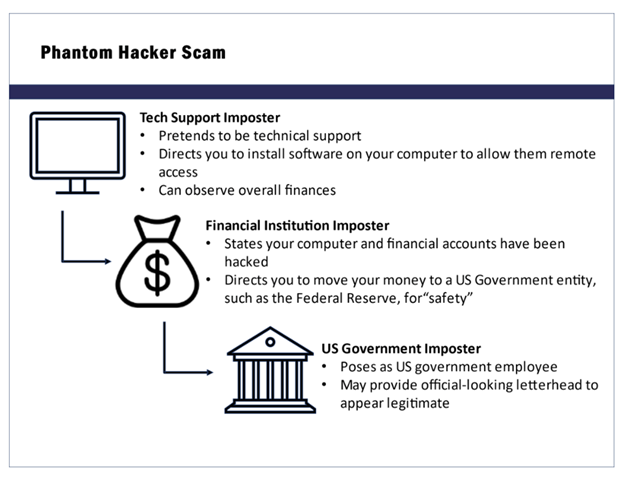

How the Scam Works: The Three-Phase Attack

This fraud unfolds in three parts, designed to gain your trust and access your accounts:

- The Tech Support Imposter: It starts with a call, text, or pop-up message claiming your computer or device has been compromised. The scammer, posing as a tech support agent, then instructs you to download remote access software, giving them control of your device and a look at your financial accounts.

- The Financial Imposter: Next, another scammer calls, pretending to be from your credit union or financial institution. They warn you that a hacker has breached your accounts and pressure you to move your money to a "safe" government-protected account using wire transfers, cryptocurrency, or cash.

- The Government Imposter: In the final phase, a third scammer impersonates a U.S. government official, often from the Federal Reserve, to pressure you to act quickly and transfer your money for "protection." They may even use official-looking documents to convince you that the transfer is legitimate.

The Phantom Hacker scam diagram courtesy of FBI Public Service Announcement

Why This Scam is Harder to Spot

Scammers are using AI to make their schemes more effective than ever. They can:

- Spoof Caller ID to make their calls appear to be from a legitimate company or government agency.

- Use AI to identify personal interests on social media, to make more believable connections, especially among older users on platforms like Facebook

- Generate Deepfake Voices that sound exactly like a bank official or a federal agent, making the call feel authentic.

- Create Convincing Emails and documents with official logos and language to make their lies more believable.

For more detail the “Phantom Hacker” scam, check out this Public Service Announcement put out by the FBI.

How to Protect Yourself

As your trusted financial partner, we urge you to be vigilant. Remember these key protective measures:

- Educate and Discuss: Regularly and openly discuss online scams with older family members to increase their awareness and reduce vulnerability.

- Slow Down and Verify: Be wary of any unsolicited call, text, or email that creates a sense of urgency. Take the time to verify the sender's identity.

- Never Grant Remote Access: A legitimate company will never ask you to download software to give them remote control of your computer.

- Trust Your Instincts: If a request sounds too good to be true or makes you feel uneasy, it's a red flag.

- Contact Us Directly: If you receive a suspicious call or message claiming to be from Wright-Patt Credit Union, hang up immediately. Do not use any contact information provided by the caller. Instead, call us directly at a phone number you know is correct, or visit your local branch.

Your security is our priority. By staying informed and cautious, you can help protect yourself and our community from these sophisticated scams.

8/6/2025

Fraud Alert: Deceptive UCC Filings

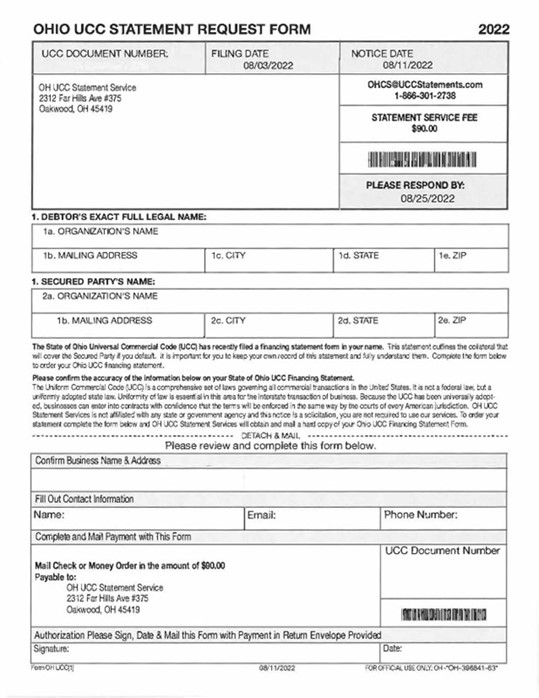

Members should be on the lookout for deceptive schemes related to Uniform Commercial Code (UCC) filings. Scammers are sending misleading solicitations—by mail and potentially online—that offer to "obtain and mail a hard copy" of various state forms for a fee (generally around $100)—documents that can be obtained for free from the state.

Example of a fraudulent Ohio UCC Request.

Although the communication appears official, this is a somewhat dubious and deceptive practice.

These misleading, yet very official-looking letters and emails are not from any government agency. Again, the forms they are referencing are available for free on the Ohio Secretary of State’s website at https://ucc.ohiosos.gov.

If you receive a similar suspicious solicitation, do not pay. You can report it to the Ohio Secretary of State's office by emailing [email protected] or calling 877-767-3453 (877-SOS-FILE).

If you are an Ohio business owner, you can also find more information about other deceptive schemes and scams here: Important Warnings For Ohio Businesses - Ohio Secretary of State

At Wright-Patt Credit Union, we're dedicated to helping you protect you, your family, your money and your business from fraud. Please stay vigilant and always verify official-looking communications.

6/23/2025

Don’t Fall for Fake WPCU® Texts

Once again, we’re seeing a rise in fake texts claiming to be from Wright-Patt Credit Union®. These fraudulent texts claim that there's a pending or suspicious transaction on your account and ask that you click a link to verify.

Do not click on any links in these text messages! It’s a scam designed to steal your personal or account information. Don’t fall for it!

Remember, WPCU will NEVER text, call, or email you out of the blue asking for your password, PIN codes or personal/account information.

If you receive a text, call or email appearing to be from Wright-Patt Credit Union, no matter how legitimate, convincing or urgent the request is, do not do any of the following:

- DO NOT share any personal info.

- DO NOT click any links.

- DO NOT call any provided numbers.

- DO NOT enter info on linked websites.

As always, when in doubt, reach out to us directly. Delete the text or hang up the phone immediately and call Wright-Patt Credit Union at (937) 912-7000 or (800) 762-0047 or visit our website at WPCU.coop to log into Online Banking.

Spot the Signs: Protect Yourself

Staying vigilant is your best defense against these scams.

- Examine the Sender: Is the text from an unfamiliar number?

- Check for Urgency/Threats: Does the message pressure you to act immediately or contain threats?

- Hover Over Links (if on a computer): See the true destination of the link before clicking. On a mobile device, it's safer to avoid clicking altogether.

- Grammar and Spelling: Scammers often make mistakes.

For more fraud and cybersecurity tips and best practices, visit WPCU.coop/StopFraud.

5/2/2025

Beware of Scam Calls Claiming Fraud and Requesting Card Details!

We have received multiple reports that Wright-Patt Credit Union® cardholders—and credit and debit cardholders in general—are being targeted by fraudulent phone calls asking for sensitive account information.

Scammers are contacting members claiming there is fraudulent activity on their account and that a new card is being expedited to them. As part of this fake process, they are asking for key account information, such as the last 8 digits of your card number, the CVV code, and the expiration date.

This is a SCAM!

Remember, Wright-Patt Credit Union will NEVER call you out of the blue or unsolicited and ask for this type of detailed card information.

If you receive a call, text or email asking for your card details—or any personal or account information.

- DO NOT provide any information.

- DO NOT click any links.

- DO NOT call any provided numbers.

- DO NOT enter info on linked websites.

- HANG UP IMMEDIATELY.

If you are unsure or concerned about potential fraud on your account, always contact Wright-Patt Credit Union directly using the official phone numbers listed on our website or your account statements: (937) 912-7000 or (800) 762-0047.

You can also log in to your Online Banking account at WPCU.coop to review your transactions.

Protect your information and remain vigilant! Share this warning with others.

3/19/2025

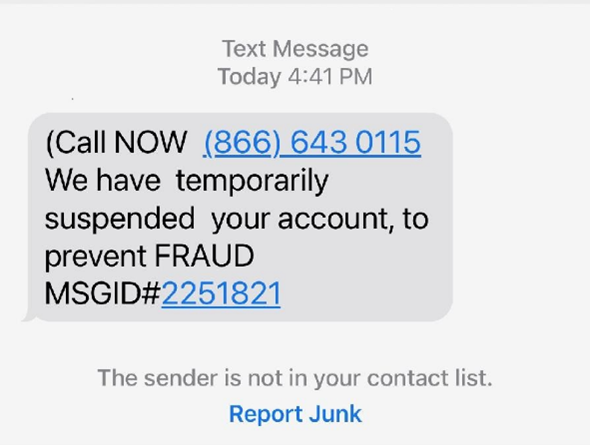

Fake Texts from Fraudsters on the Rise

We are seeing a rise in fake texts from fraudsters claiming to be from Wright-Patt Credit Union®.

The scammers will often ask you to click a link to dispute or to verify charges. They will use urgent, often alarming language to scare you into thinking your account has been compromised. Don’t fall for it!

Remember, WPCU will NEVER text, call, or email you out of the blue asking for your passwords, PIN codes or personal/account information.

If you receive a suspicious message:

- DO NOT share any personal info.

- DO NOT click any links.

- DO NOT call any provided numbers.

- DO NOT enter info on linked websites.

Delete the text or hang up the phone immediately and call Wright-Patt Credit Union directly at (937) 912-7000 or (800) 762-0047 or visit our website at WPCU.coop to log into Online Banking.

For more fraud and cybersecurity tips and best practices, visit WPCU.coop/StopFraud.

Spotting Phony Texts, Calls, and Emails to Protect Your Hard-Earned Cash

Fraudsters are good at two things: Pretending to be someone they’re not—and stealing your money and even your identity. Their favorite tools? Using fake texts, calls, or emails disguised as legitimate sources like your credit union.

These scams can be incredibly convincing, but don't worry! By understanding how they work and recognizing the red flags, you can stay safe. Here's a few tips to help keep your money safe.

The Scammer Playbook:

These crafty and unscrupulous fraudsters love to exploit your trust. They might:

- Pretend to be from your credit union: They can even spoof our phone numbers or email addresses to make it seem like we're contacting you! Unfortunately, you can’t always trust your caller ID.

- Create a sense of urgency: They'll claim your account is compromised, suspicious activity has been detected, or a prize awaits - all to pressure you into acting quickly without thinking.

- Lure you with malicious links: These links, disguised as buttons or embedded in text, can lead to fake websites designed to steal your information.

- Offer "too-good-to-be-true" deals: Free money, debt forgiveness, or exclusive offers are classic bait. Remember, if something sounds too good to be true, it probably is!

Spotting the Fakes:

Stay vigilant by looking for these red flags:

- Grammar and spelling errors: Professional communication, like from your credit union, wouldn't have these mistakes.

- Unfamiliar email addresses or Web addresses with odd syntax: Double-check! Even if the name seems familiar, verify the actual address or number. Even then, it’s always best to contact us directly.

- Requests for personal information: We'll never ask for your account details, passwords, or Social Security number through unsolicited messages.

- Suspicious attachments: Never open attachments from unknown senders. They could contain malware.

- High pressure tactics: Scammers will try to use urgency and fear tactics against you. Don't be rushed. There’s always time to reach out to us directly and verify any message before taking action.

Your Fraud Defense Plan:

Remember, you're in control. Here's how to fight back:

- Never click on suspicious links: If you're unsure, hover over the link to see its true destination. Better yet, don't click at all!

- Don’t provide personal or account information, i.e., username, password, or security code into a website the text takes you to.

- Don't reply to suspicious messages: Engaging with scammers gives them more information and confirms your contact details.

- If you're unsure, call us directly: Don't use phone numbers or links provided in the message. Contact us through our website or the phone numbers provided below.

- Report suspicious activity: If you receive a phishing attempt, report it to us so we can warn other members.

- Educate yourself and others: Knowledge is power! Share these tips with family and friends to help them stay safe.

Remember: If you receive a text, call or email appearing to be from Wright-Patt Credit Union, no matter how legitimate, convincing or urgent the request is, do not do any of the following:

- DO NOT share sensitive account/personal information

- DO NOT click on any links in texts or email.

- DO NOT call any numbers provided.

Delete the text or hang up the phone immediately and call Wright-Patt Credit Union directly at (937) 912-7000 or (800) 762-0047 or visit our website at WPCU.coop to log into Online Banking.

For more fraud and cybersecurity tips and best practices, visit WPCU.coop/StopFraud.

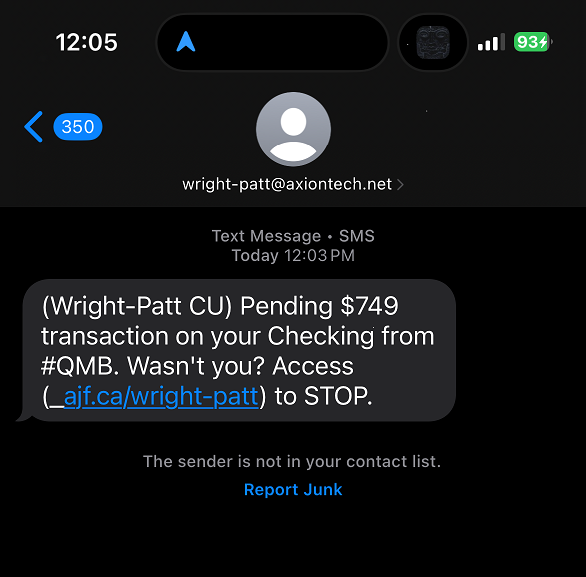

Fake WPCU Texts and Calls on the Rise

New year. Same old scams. Members have reported seeing a rise fake calls and texts from fraudsters claiming to be from Wright-Patt Credit Union® (WPCU).

The scammers will often ask you to click a link to “accept or reject” fake charges or to verify account credentials, as well as other tricks to steal your private information—and your money. They will use urgent or alarming language to scare you into thinking your account has been compromised. Don’t fall for it!

Remember, WPCU will NEVER text, call, or email you out of the blue asking for your passwords, PIN codes or personal/account information.

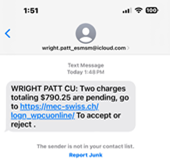

Example of fraudulent WPCU text:

If you receive a text, call or email appearing to be from Wright-Patt Credit Union, no matter how legitimate, convincing or urgent the request is, do not do any of the following:

- DO NOT share sensitive account/personal information over the phone.

- DO NOT click on any links in texts or email.

- DO NOT call any numbers provided.

- DO NOT enter any personal or account information, i.e., username, password, or security code into a website the text takes you to.

Delete the text or hang up the phone immediately and call Wright-Patt Credit Union directly at (937) 912-7000 or (800) 762-0047 or visit our website at WPCU.coop to log into Online Banking.

For more fraud and cybersecurity tips and best practices, visit WPCU.coop/StopFraud.

12/14/2023

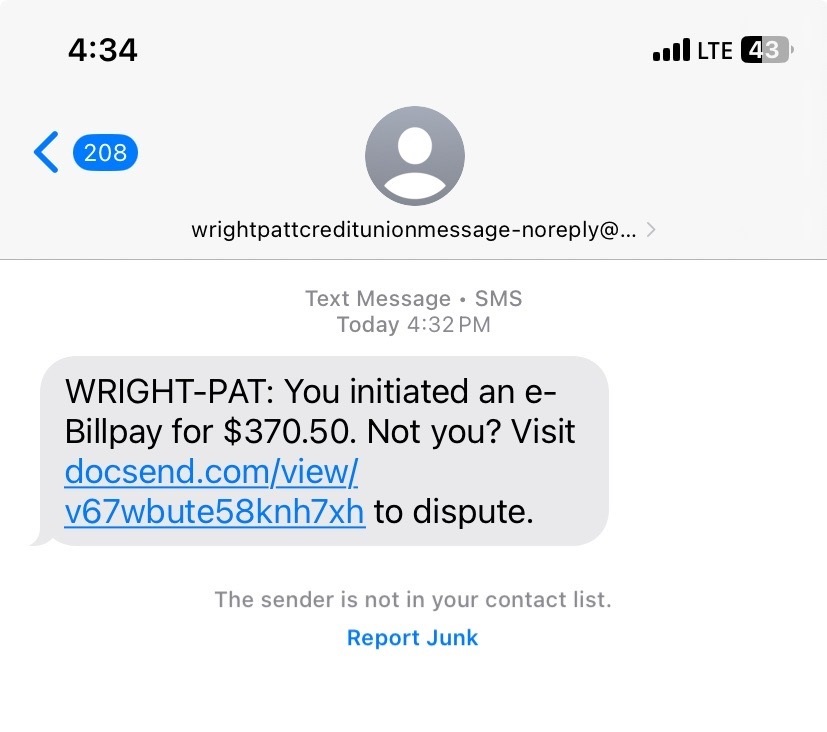

Fake WPCU texts try to scare members by reporting log-ins to their account from unrecognized devices—DO NOT CLICK LINKS

Fraudsters are at it again, targeting Wright-Patt Credit Union members as well as those of other financial institutions with fake text messages.

In the texts, the scammer "warns" members about someone logging in to their account from an unrecognized device and instructs them to click a link to cancel. This is yet another variation of common text and email scams.

Remember, scammers use urgent and compelling language to trick members into clicking links in attempt to steal account and personal information. THIS IS A SCAM. Do not click links in texts. Do not give our your personal or account information. WPCU will never ask you to do this.

Here's an example of a recent fake text received by a member.

Remember, Wright-Patt Credit Union will NEVER text, call, or email you asking for personal or account information.

If you receive a text, call or email appearing to be from Wright-Patt Credit Union, no matter how legitimate, convincing, or urgent the request is, do not do any of the following:

- DO NOT click on any links.

- DO NOT call any numbers provided.

- DO NOT enter any personal or account information, i.e., username, password, or security code into a website the text takes you to.

- Delete the text or hang up the phone immediately and call Wright-Patt Credit Union directly at (937) 912-7000 or (800) 762-0047 or visit our website at WPCU.coop to log into Online Banking.

1/31/2023

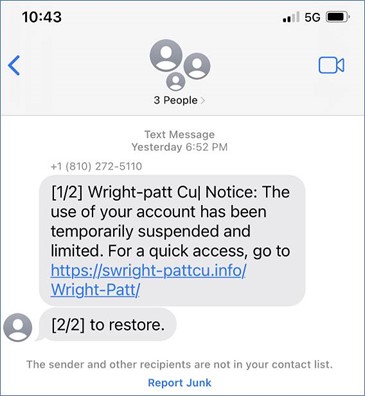

Fake WPCU text claims your account has been temporarily suspended and provides a link to restore access.

Fraudsters continue to target Wright-Patt Credit Union members as well as those of other financial institutions. Now scammers are sending texts stating that the recipient's account has been “temporarily suspended." In the text, the scammer instructs the recipient to click on a link to restore their account. Below is an example of the text. This is a scam!

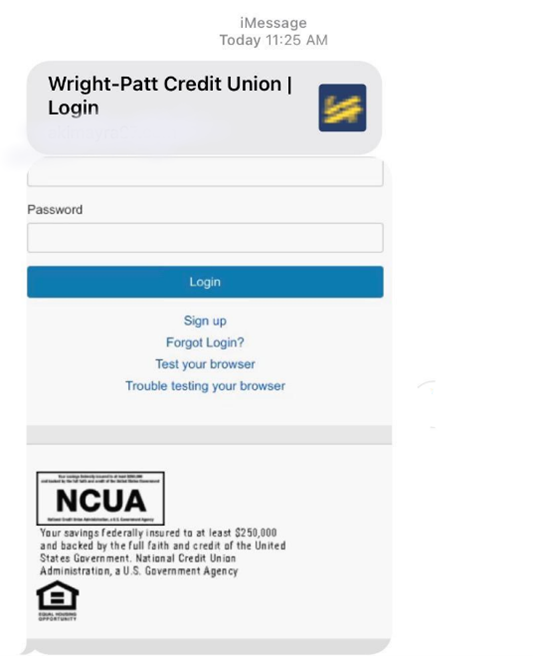

When clicking on the link, the recipient is taken to a fake website that appears to be a Wright-Patt Credit Union website and asked to enter personal and account information such as their name, account number, SSN, and online/mobile banking username and password.

Members have reported receiving fraudulent texts from the numbers below, but these are only just a few.

- (937) 689-9349

- (810) 272-5110

- (810) 213-6408

The fraudulent links in these texts often incorporate variations of the WPCU name (sometimes with nonsense words preceding the WPCU reference) in the website address to appear more valid, including:

- https://swright-pattcu

- https://wrightpat

- https://wrightpatt

- https://wrightpattcreditunion

- https://inflex.info/wrightpat

These websites may also include the WPCU logo or elements of it (e.g., the biplane). Do not fall for these fakes.

Wright-Patt Credit Union will NEVER text, call, or email you asking for personal or account information.

If you receive a text, call or email appearing to be from Wright-Patt Credit Union, no matter how legitimate, convincing or urgent the request is, do not do any of the following:

- DO NOT click on any links.

- DO NOT call any numbers provided.

- DO NOT enter any personal or account information, i.e., username, password, or security code into a website the text takes you to.

- Delete the text or hang up the phone immediately and call Wright-Patt Credit Union directly at (937) 912-7000 or (800) 762-0047 or visit our website at WPCU.coop to log into Online Banking.

12/20/2022

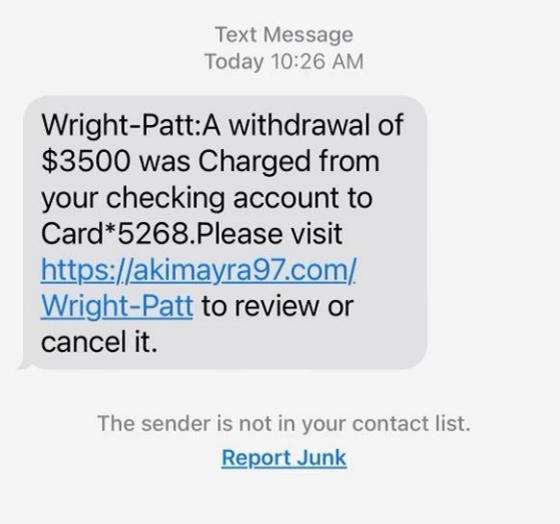

Fraudsters Targeting WPCU Members and Other Financial Institution Customers with Fake Texts and Calls

Along with many other financial institutions, Wright-Patt Credit Union is continuing to see a rise in fraudulent attempts to gain unauthorized access to member accounts. Fraudsters are contacting members via text messages and phone calls falsifying information to make it appear the texts and calls are from Wright-Patt Credit Union.

Below are examples of some of the texts members have received:

When clicking on the link in the first example above, the member is taken to a fake website that appears to be a Wright-Patt Credit Union website. The website looks like the site below. Upon entering their username and password, members are then asked to enter their Social Security number and full debit and/or credit card number.

Wright-Patt Credit Union will NEVER text, call, or email you asking for personal or account information.

If you receive a text, call or email appearing to be from Wright-Patt Credit Union, do not do any of the following, no matter how legitimate, convincing, or urgent the request is.

- DO NOT click on any links

- DO NOT call any numbers provided

- DO NOT enter any personal or account information, i.e. username, password, or security code into a website the text takes you to.

Delete the text or hang up the phone immediately and call Wright-Patt Credit Union directly at (937) 912-7000 or (800) 762-0047 or visit our website at WPCU.coop to log into Online Banking.